Understanding The Impact of Financial Technology Solutions in Africa

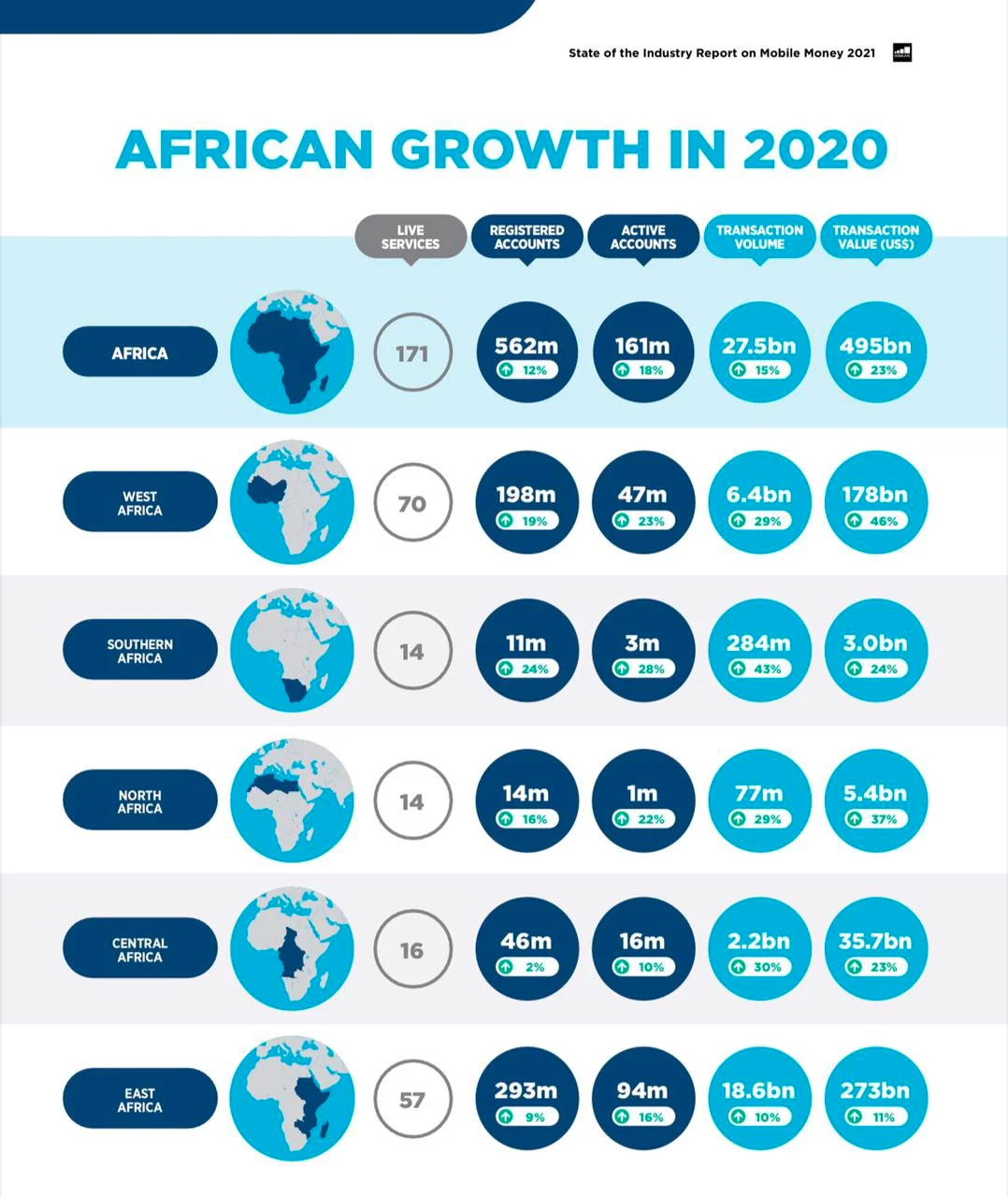

According to GSMA, in 2020, Africa had 562 million registered mobile money accounts, representing a 12% growth from 2019.

The total transaction value of money changing hands throughout the year was a whopping $495 billion, representing 65% of the global mobile money transactions.

By far, East Africa took the highest share of the transaction value representing 57% of the $495 billion, followed by West Africa with $178 billion of the total transaction value.

Central Africa, North Africa and Southern Africa accounted for less than 10% of the total transaction value, indicating nascent opportunities ripe for disruption.

Nevertheless, Southern Africa continues to show promising signs of further growth. The region had a 24% year on year growth in registered accounts which indicated the fastest growth across the continent.

From this data, it is clear that Africa has cemented its role as a global leader in mobile money. Consequently, mobile money has also become synonymous with the growth and development of the financial services sector in the continent.

FinTechs have also catalysed the market by laying out a strong foundation causing banks and other financial services providers to up their game with more targeted consumer offerings.

The rise in smartphone users and the reducing cost of the internet are integral factors contributing to the rise of FinTech in the continent. As a result, FinTech funding grew to $1.35 billion in 2020 from $1 billion in 2019.

High profile mergers and acquisitions in the sector have also been an excellent marker of the drive to invest in the most promising startups driving innovation and bolstering financial inclusion.

With a vast number of Africa’s population still locked out of formal financial services, FinTech promises robust solutions to financial inclusion and deepening access to finance.

Moreover, the economic value of FinTech solutions stands to uplift many vulnerable households out of poverty.

For example, research done on the impact of mobile money in Kenya found that access to mobile money reduces the number of people in extreme poverty. FinTech solutions can either be B2B or B2C and cover the following main areas:

Insurance technology: this category covers different types of technology innovations that help insurance companies run more efficiently and effectively

Digital banking: this involves digitization of the traditional bank services and programmes that have previously been available exclusively at a physical branch

SME solution track: some FinTech companies solve specific problems that plague Micro, Small and Medium Enterprises (MSMEs)

Payments: Innovations around payments have the end-user in mind. These items have been continuing to leapfrog the unbanked individuals into being formally financially included.

Savings/Investments: these types of FinTech solely act as a vehicle enabling consumers to execute their savings and investment plans.

Financial Infrastructure: these innovations are geared to optimising and improving financial transactions

Credit: FinTech solutions attached to credit give consumers access to loans quickly and efficiently

The different solutions offered by FinTech companies represent a status quo shift in the financial services sector.

Across the seven FinTech sub-sectors, companies are redefining financial inclusion and deepening access to finance while improving operational modalities that are quickly becoming the benchmarks for industry best practices.

According to the State of FinTech In Emerging Markets report by the Catalyst Fund and Britter Bridges, payment and credit solution companies continue to receive a considerable portion of the investments in the FinTech space despite there being a wide array of solutions available.

Insurance technology, financial infrastructure and digital banking follow payments and credit companies by a considerable margin, and SME solutions companies have a dismal feature in the funding landscape.

The majority of the payment companies that receive a large share of the funding primarily operate on a B2B and B2B2C model.

Payment and credit companies have garnered a lot of investment interest due to the transformative nature of their operations, leading to increased access, better services, and gains in efficiency at scale.

While FinTech companies bring significant gains in the development of the financial services sector, it is critical to strike a sustainable balance while weighing the benefits and potential gains of FinTech and the concerns arising from using the companies' new technologies and business models.

Since most FinTech solutions are centred around providing secure digital infrastructure and facilitating the movement of money from one place to the other safely while accumulating vast amounts of personal data from consumers, policies regulating these companies need to be robust and well thought out.

A common pitfall is that most countries struggle to have their regulators keep up with the fast-paced and highly dynamic nature of FinTech operations. The lack of coordination among regulators results in a low regulatory response speed, which leaves the sector exposed to many vulnerabilities that could leave consumers bearing the brunt of the market inefficiencies.

A great example is the exorbitant digital lending rates offered by non-bank lending companies in Kenya. As is the case elsewhere on the continent, Bank lending institutions in Kenya are regulated by the Central Bank. According to this article, bank lending rates are capped at 12% per annum. Since lending has previously been left at the discretion of digital lenders, some companies end up charging rates as high as 36% annually, depending on the amount borrowed and the borrower’s credit history.

Kenyan lawmakers recently passed a law protecting borrowers from predatory lending.

Regulation of FinTechs needs clear policies that take a risk prevention approach and enhance these companies' sustainable growth and development. Regulatory bodies should also improve coordination among the relevant agencies to ensure adaptability and more proactive and less reactive policies.

There should also procedures and information on the current regulations in place and how they affect operating companies and consumers. Extensive engagement with FinTech businesses by the regulators is also crucial in shaping the dynamics of the sector, i.e. regulators building capacity among existing companies.